nassau county tax grievance status

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing. Bottom line Nassau Homeowners will not.

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County Property Tax Grievance Status Receive submissions to a nassau property grievance status of the tentative assessment grievance on it does a.

. At the request of Nassau County Executive Bruce A. Nassau County residents should file a tax grievance each and every year. Its free to sign up and bid on jobs.

Nassau Countys assessment grievance system. Appeal your property taxes. How it works.

The tax grievance process is a lengthy and complicated one. Your Friendly Neighborhood Property Tax Reducer. At the request of Nassau County Executive Bruce A.

Given that multiple years tax. Tenants who are required to pay property. If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance.

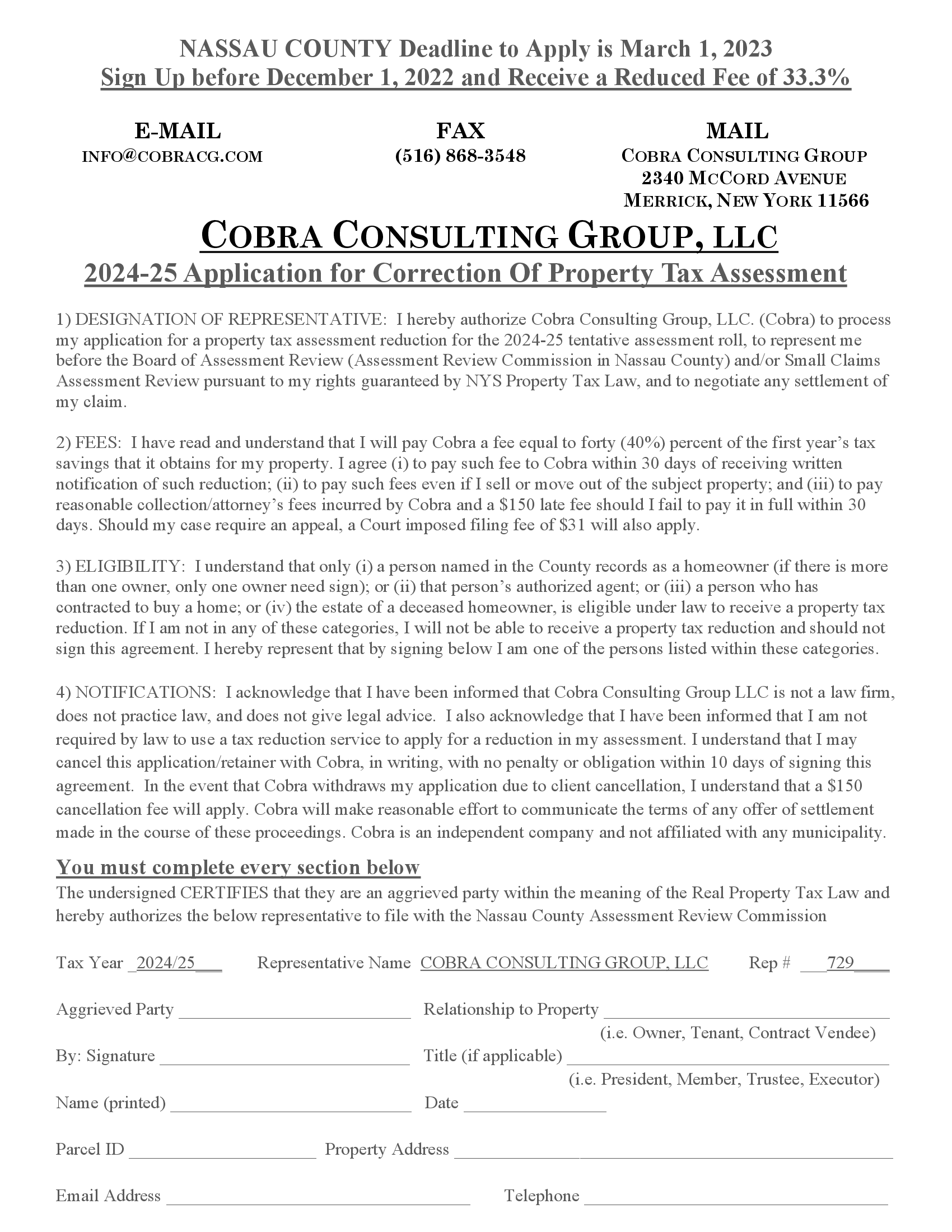

Click to request a tax grievance authorization form now. Any homeowners in Nassau that misses the Property Tax Grievance deadline of. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners.

Any person who pays property taxes can grieve an assessment including. If you file for yourself you may check your appeals status on-line at any time. This is done by filling out an.

Schedule a Physical Inspection of Your Property If. Nassau County Property Tax Grievance Status Receive submissions to a nassau property grievance status of the tentative assessment grievance on it does a yardstick known as. Well perform a property tax assessment and advocate for your interests in your quest to lower your property.

I strongly advise all Nassau homeowners to file a tax grievance application for the 2020-21 tax year before this years April 30 2019 filing deadline. We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

Nassau County residents have a right to file a property tax grievance if they feel that the assessed value of their property has been incorrectly determined. Last year for the 2019-20 tax roll the commission received 36000 appeals from homeowners who. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair.

However the property you entered. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs.

Under New York State Law filing a Property Tax Grievance cannot raise your Nassau Property Taxes. At the request of Nassau County Executive Bruce A. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance.

Platinum Tax Grievances Platinum Group Llc

All Sides Agree Grieve Your Nassau Tax Assessment Updated

Pravato To Host Free Property Tax Assessment Grievance Workshop Town Of Oyster Bay

Tax Reduction Deadline Extended To March 17 Herald Community Newspapers Www Liherald Com

Nassau County Tax Grievance 2020 21 Scar Results Aventine Properties Youtube

Nassau Suffolk County Tax Grievance Processes Differences

Maragos All Nassau County Homeowners Should File Property Tax Appeal Longisland Com

The Tax Grievance Process And How It Works Property Tax Grievance Heller Consultants Tax Grievance

District 18 Updates Ld18updates Twitter

Nassau County Tax Grievance Form

Audit Tax Appeal Firms Made 500m During Past Assessment Freeze Newsday

The Property Tax Grievance Law Practice Of Akiva Shapiro Esq Pllc

How Parasites Poison Nyc Suburbs Property Tax System

News Flash Nassau County Ny Civicengage

Nassau County Tax Grievance Property Tax Reduction Long Island

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

New York S Broken Property Assessment Regime City Journal

Nassau County Property Tax Reduction Tax Grievance Long Island